According to the Knight Frank Active Capital 2020 study, it is predicted that in 2021 the focus of investors will be on capital flows to the countries of refuge, as well as to the “nearest neighbors”, where potential operational barriers are lower and the risks are more understandable. Among such specific jurisdictions, Georgia for business in 2021 may become an ideal “quiet bay” for creating a new direction or relocating its activities.

Taxes in Georgia in 2021

An important trend for the Georgian government remains the creation of preferential tax regimes for international business, to the popular form of IT companies with the status of a virtual zone, which are exempt from income tax and VAT, in the fall of 2020, the Government introduced an even more preferential organizational and legal form - International Companies.

The established incentives for international companies have become an additional motivation for companies to relocate their activities to Georgia. The new tax regime for international companies encourages multinational corporations to relocate their IT service centers to Georgia. Thanks to this, they not only save on taxes but can also count on reducing labor costs. The second type of company to which the new benefits are applicable is shipping.

One of the main conditions for obtaining the status of an international company and, therefore, obtaining tax benefits is that the applicant has at least two years of experience in these areas (IT and shipping). In addition, it is necessary to demonstrate the existence of the actual presence of the business in Georgia (expenses incurred in Georgia, the presence of hired personnel in the country, etc.).

Information technology services must be provided to persons whose place of registration or place of management is outside Georgia. These services may include:

- Software release;

- Publishing computer games;

- Computer programming, consulting and related activities.

In fact, international companies will pay only 5% of the withdrawn profit (do not forget that in Georgia there is an Estonian capital reinvestment model, there is no mandatory monthly payment) and 5% when paying salaries, which significantly reduces the tax burden on business.

At the end of 2020, several large international companies were officially announced to move to Georgia. Among them is EPAM Systems, which has already started registering a subsidiary in Georgia. EPAM Systems is an American IT company founded in 1993. The world's largest manufacturer of custom software, consulting specialist. Annual turnover of $ 2.29 billion, 36,700+ employees.

The state policy in the field of taxation remains as loyal as possible and aimed at creating comfortable conditions for doing business in the country. 2020 brought its own adjustments, namely the introduction of certain tax incentives for entrepreneurs, for example, during the crisis period, reliefs were introduced in the payment of income tax, salaries up to a certain level (750 lari gross) were exempted from paying the so-called personal income tax, for payments up to 1500 lari gross tax reduced by half.

Popular and profitable areas for investment in Georgia in 2021

First of all, the most popular and profitable area for investment in Georgia is IT business and the forms of its conduct - a virtual zone and international companies. It should be noted that the virtual zone of Georgia corresponds to the new model for IT - 'Anywhere operations'. It is designed for flexible user support. This is convenient because employees have constant access to all necessary data from anywhere and from any device.

According to Gartner, by the end of 2023, about 40% of organizations will have implemented an “Anywhere” model to optimize employee performance and customer interactions. First and foremost, this requires secure remote access, cloud and edge infrastructure, and automated support for remote operations.

The Georgian government is also actively developing the “Invest in Georgia” and “Produce in Georgia” programs. Since 2017 these programs have been working in three directions:

- Help for small and medium-sized businesses.

- Attracting foreign investment to Georgia and promoting the country at the international level.

- Creation of production facilities in Georgia aimed at export and job creation.

Industries for which this program was most in demand:

- Construction;

- Manufacturing (food and beverage).

As of January 1, 2019, 278 enterprises received state support totaling 640 million lari. As a result, more than 11,500 new jobs were created.

Operating costs for companies that relocated their production or invested in Georgia are 25% - 40% lower than normal costs in Europe, the USA, and Israel. For example, if you want to hire and train local mechanics, you can get government funding.

Thus, the trend of attracting investment is not only virtual companies, partially doing business from the country, but also real production, which stimulates significant economic growth and job creation. It is also important that these state programs can be used not only by local entrepreneurs but also by foreign investors.

Doing Business in Georgia in Free Industrial Zones

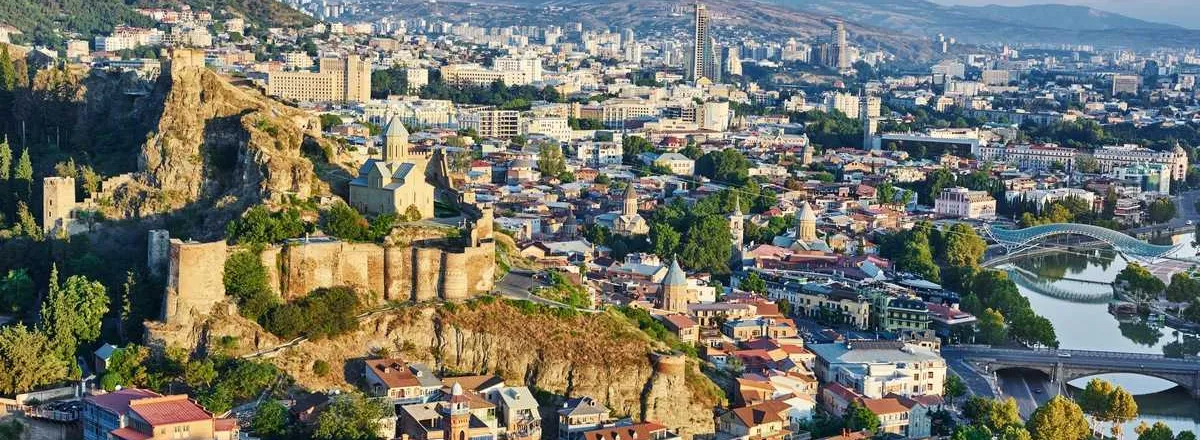

Free industrial zones of Georgia, located in the three largest cities - Tbilisi, Kutaisi, and Poti, have been especially popular among foreign investors for several years for many reasons, including:

- Special tax regimes, almost all taxes are equal to 0. So, for example, the owner of the company can withdraw dividends indefinitely without paying any tax.

- There is no need to file reports frequently. In fact, 80% of companies absolutely legally do not submit tax and financial statements to regulatory authorities.

- There is everything you need for production and export in the form of a developed infrastructure. FIZ is a long-term successful project that is constantly expanding its presence, so, despite the crisis of 2020, FIZ Tbilisi opened and launched a second complex of office and warehouse premises to attract investors this fall.

- Convenient location of Georgia at the junction of Europe and Asia.

- Low unit cost and minimal operating costs for the business. The average salary in the country is still below $ 500, and, for example, class B office rent starts at $ 10 per sq. m.).

- The widest list of existing agreements on free trade in the CIS.

Preferential prices for electricity and other utilities. Thus, low electricity tariffs have become one of the main reasons for the transfer of mining crypto companies to Georgia, which is currently the third-largest cryptocurrency mining company in the world.

FIZ is in demand, first of all, among owners of medium and large businesses, for whom the payment of an annual license and obtaining a tax-free status is much more profitable than the classical taxation model.

Foreign freelancers, special taxation and conditions

As before, it is very popular in Georgia to conduct an entrepreneurial activity through the status of a small business - registration of an individual entrepreneur with a small status.

Freelancers from Europe and the CIS - Ukraine, Belarus, Russia, register individual entrepreneurs in the country and continue to work with international clients. The reasons are obvious and really valid:

- With an annual turnover of up to $ 165,000, income tax is only 1%, there are no additional social contributions.

- The conditions for registering an individual entrepreneur are the same for both residents and non-residents of the country, the procedure is simplified as much as possible, it is possible to go through it remotely by proxy, and it only takes a couple of days to obtain a special status.

- You can accept fees for services to an account in any international bank or payment system, for example, the most popular systems TransferWise and PayPal easily and quickly register Georgian users, and withdrawing funds to a Georgian card takes a matter of minutes.

- There are no additional administrative costs for accounting and tax accounting - you can submit declarations and pay taxes online, without any special preparation, the process takes more than 30 minutes a month.

More than 10 reasons to open a Georgian company in 2021

In terms of diversifying international entrepreneurship, Georgia has a number of other advantages for business in 2021. In addition to loyal tax regimes, it is beneficial for entrepreneurs to do business in the country for the following reasons:

- In Georgia, convenient banking tools that allow you to manage your business from anywhere in the world, it is possible to open a bank account and full access to it without being present in the country;

- Low labor cost;

- Operating costs for companies are lower than in most countries, for example, there are no requirements for an annual audit, and as a result there are no additional costs for company maintenance;

- Free trade agreements with 56 countries (CIS, European Union, EFTA, China, Turkey, Ukraine, Great Britain, Hong Kong) and easy access to the international market;

- Estonian model of the tax system, which guarantees exemption from corporate income tax when income is reinvested;

- There is no currency control in Georgia;

- The company can be managed remotely;

- Your tax information will not be transferred according to the CRS standard (the first exchange is planned for 2023 with Germany);

- The capital of Georgia - Tbilisi is located in 2 hours of flight from all European countries and major cities of the CIS;

- Almost complete absence of bureaucracy and modern government programs to support business;

- Loyal policy of the tax service, the minimum number of checks and communications in principle.

One of the key benefits of doing business in Georgia for international companies is affordability. Easy access to the country (liberal visa regime), easy access to decision-makers and authorities, and a well-functioning banking system provide access to finance. Georgia for business in 2021 can suit a wide variety of forms of business, not only IT but also the construction, food, electronics, components for the aerospace and automotive industries, as well as other industries. Convenient location on the map, mild climate, and the opportunity to obtain a residence permit in exchange for investment, coupled with inexpensive real estate, create an excellent platform for development in the post-crisis period.

There are a lot of options for development, investment, and business transfer. To know exactly which sector to invest in and which preferential tax regime is right for you - leave a request on our website and we will conduct a free consultation.